There has been a dramatic shift in the nature of programmatic advertising over the years; programmatic advertising used to be dominated by purchasing large quantities of impressions regardless of their targeting or performance, but now it is the opposite - you are able to purchase individual impressions with complete accountability for each one and measure how well they performed for your business.

There are two main programmatic advertising platforms available today, Amazon DSP and The Trade Desk (TTD). Although they are frequently thought of as "direct competitors", these two platforms have very different business models and provide advertisers with different unique benefits as a result.

Brands that want to effectively scale across digital, in-app, and connected TV advertising platforms must have a clear understanding of the key differences between Amazon DSP and TTD.

As such, Neil Kettleborough has provided a comprehensive overview of the real differences in common, straightforward language, with the primary focus being to enable advertisers to make more effective and informed decisions.

What Is Amazon DSP?

Amazon DSP provides advertisers to purchase display, video, and CTV media based on real shopper signals through Amazon's first-party data ecosystem:

Real purchase history to identify customers who are more likely to convert.

True browsing behaviour data that lets advertisers secure an ad buy based on products that shoppers have viewed or searched.

Real cart activities (i.e. items added to the cart but not purchased) which allows advertisers to retarget shoppers more effectively.

Real product views and completed sales so advertisers can see how effective their advertising spend has been at getting people to engage with the advertised product and purchase it through completed sales.

Unlike many other DSPs, Amazon DSP doesn’t rely on assumptions or proxy data. It uses actual consumer actions, making it one of the most performance-driven programmatic media buying platforms in the market.

What Is The Trade Desk?

The Trade Desk is an independent, open-internet DSP. It does not own inventory or audience data. Instead, it acts as a central buying and decision platform that connects advertisers with:

Supply-side platforms (SSPs), enabling access to a wide range of ad inventory across websites, apps, and streaming environments.

Premium publishers, allowing brands to place ads on trusted, high-quality media properties at scale.

Third-party data providers, helping advertisers build and refine audience targeting using external data sources.

Measurement and creative tools, giving brands the ability to track performance, optimise campaigns, and manage creative efficiently.

This independence gives advertisers control and flexibility, especially for omnichannel strategies.

How Does The Trade Desk Work in Practice?

The Trade Desk enables advertisers to plan and activate campaigns across multiple channels from a single platform, simplifying complex omnichannel management.

Core Capabilities:

Purchasing display; video; audio; native; and CTV; consistently reach their audiences through digital, mobile, and streaming platforms.

Integration with all external audience data providers gives brands the flexibility to access third-party data to build segments that meet their needs.

Provide custom analytics and reporting so advertisers can review their performance across channels to make data-led optimisation decisions.

Publisher optimisation allows advertisers to have absolute control over ad placement and their budget allocation.

Its main strength lies in choice, as advertisers can select the partners, data sources, and tools that best align with their strategy. However, as Neil Kettleborough notes, reliance on integrations can introduce challenges:

Data gaps, where fragmented systems reduce visibility across the full customer journey.

Attribution challenges, making it harder to connect ad exposure to real business outcomes.

Reduced accuracy in a privacy-first world, as tighter regulations limit the effectiveness of third-party data.

How Does Amazon DSP Work Differently?

Amazon DSP operates as a vertical, outcome-focused system. Rather than stitching together multiple third-party inputs, it connects media buying directly to real commerce behaviour, allowing advertisers to optimise campaigns using actual results.

What Makes It Unique:

Built on Amazon-owned first-party data, giving advertisers access to verified shopper signals from real purchase and browsing behaviour.

Real-time optimisation based on sales signals, allowing campaigns to adjust quickly as customer intent and performance change.

Closed-loop attribution from impression to purchase, clearly showing how ad exposure leads to sales.

Native access to Amazon-owned media, including Fire TV, Freevee, and Twitch, without relying on external platforms.

This model allows advertisers to move faster from insight to action, reducing wasted spend and improving overall performance.

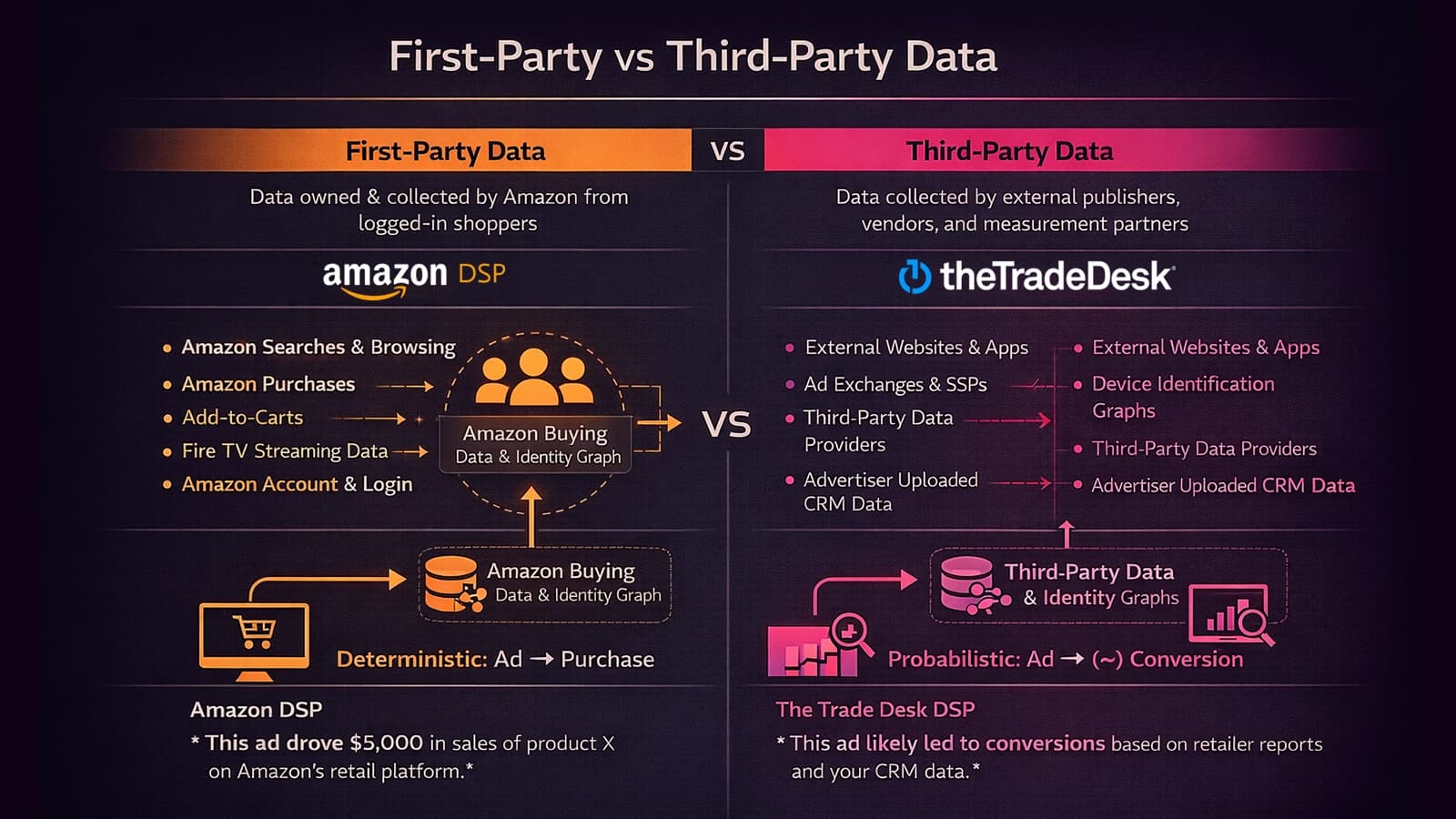

Why Is First-Party Data So Critical Now?

Privacy regulations and the loss of third-party cookies have changed the rules.

Advertisers now need data that is:

Consent-based, collected transparently and in accordance with user expectations of privacy.

Verifiable, so that brands can have confidence that their data mirrors actual user behaviour.

Linked to outcomes, enabling campaigns to correlate exposure to actions such as engagement or purchase.

First-party data meets all three requirements, making it the most reliable foundation for modern programmatic advertising platforms.

Amazon DSP’s advantage is not just scale—it is certainty. Advertisers know who they are reaching and what happens next.

Key Benefits of The Trade Desk

The Trade Desk remains a market leader for brands valuing flexibility and control.

Strategic Advantages:

Channel-agnostic buying, enabling seamless campaigns across display, video, audio, native, and connected TV.

Broad reach across the open web, helping brands scale messages beyond walled gardens.

Freedom to choose data and measurement partners, giving full control over audience building and reporting.

Strong global publisher relationships, providing access to high-quality inventory across markets.

For awareness-led or hybrid campaigns, this independence is a significant advantage.

Key Benefits of Amazon DSP

Amazon DSP is designed for performance-led growth, focusing on measurable outcomes and real shopper behaviour.

Strategic Advantages:

Purchase-based audience targeting, reaching consumers based on actual buying behaviour rather than inferred interest.

Faster learning cycles, enabling campaigns to adapt quickly based on real-time insights.

Sales-linked attribution, connecting every impression directly to purchase outcomes to prove ROI.

Direct access to premium owned media, including Fire TV, Freevee, and Twitch, giving exclusive placements in brand-safe environments.

For retail, e-commerce, and outcome-driven brands, this creates a clear advantage.

How Do the Platforms Compare for CTV?

Connected TV advertising is where the difference between Amazon DSP and The Trade Desk becomes most visible.

The Trade Desk and CTV:

Access via SSPs and publisher deals, allowing advertisers to reach premium streaming content through third-party partnerships.

Inventory across Hulu, Peacock, and Discovery+, providing broad coverage across well-known platforms.

Broad reach and scale, enabling access to large audiences across multiple CTV channels.

Limitations:

No exclusive placements, so unique premium spots aren’t guaranteed.

Limited pricing control, as rates are set by third-party inventory providers.

No direct data ownership, reducing ability to link impressions to behaviour.

Amazon DSP and CTV:

Owned inventory on Fire TV, Freevee, and Twitch, giving direct access to premium Amazon-owned streaming properties.

Priority placements, ensuring campaigns appear in high-value positions.

Brand-safe environments, allowing ads to run in controlled, high-quality contexts.

Competitive rates, leveraging owned media to offer cost efficiency.

Amazon also links CTV exposure directly to product discovery and purchase behaviour.

Which DSP Is Better for Your Business Goals?

As Neil Kettleborough explains, there is no universal answer.

The right platform depends on:

Your growth objective, as DSPs excel differently in awareness, performance, or retail campaigns.

Your reliance on performance data, since Amazon DSP provides first-party, purchase-linked data, while The Trade Desk prioritises flexibility.

Your need for flexibility versus certainty, balancing control over third-party integrations against predictable results from owned media.

Choosing a DSP solely based on reputation often leads to wasted spend.

Pros and Cons Summary

The Trade Desk

Pros:

Maximum flexibility across data providers, measurement tools, and campaign channels.

Strong omnichannel reach across display, video, audio, native, and CTV.

Open ecosystem with full control over integrations, reporting, and optimisation.

Cons:

No owned data, relying on third-party sources for targeting.

Attribution depends on integrations, making it harder to link ad exposure to outcomes.

Less direct connection to sales, lacking closed-loop measurement.

Amazon DSP

Pros:

Verified first-party shopper data for precise targeting.

Closed-loop attribution connecting impressions to sales outcomes.

Exclusive media access via Fire TV, Freevee, and Twitch.

Cons:

Less platform neutrality, with limited flexibility to use external tools.

Best suited to commerce-driven brands, less ideal for awareness-only campaigns.

Common Mistakes Advertisers Still Make

Choosing a DSP before defining objectives, leading to misaligned platform selection.

Optimising for reach instead of results, focusing on impressions over measurable outcomes.

Treating CTV as branding-only, missing opportunities to connect ads to purchase behaviour.

Ignoring data ownership, preventing the use of first-party insights for accurate targeting.

The smartest advertisers align platform capability with business intent.

Tools Used and Measurable Results

Amazon DSP Measurement:

Sales lift analysis, showing incremental purchases and revenue.

Conversion tracking, connecting impressions and clicks directly to sales.

SKU-level performance, tracking which products generate results for optimisation.

Audience retargeting based on outcomes, re-engaging users who showed interest but haven’t converted.

The Trade Desk Measurement:

Custom analytics stacks, providing flexible, campaign-specific reporting.

Independent attribution models, connecting cross-channel exposure to outcomes using third-party tools.

Cross-channel reporting, analysing performance across display, video, audio, native, and CTV campaigns.

Bottom Line

Programmatic advertising is changing from broad reach to measurable proof of effect that connects the spend of advertisers on various media with positive providing results to their business.

Amazon DSP will offer unique benefits for brands seeking retail expansion, e-commerce, and performance-based initiatives; such as access to first-party shopper data, closed-loop attribution, and exclusive media inventory.

For advertisers whose focus is on flexibility, scale, and independent control (e.g., all omnichannel campaigns), The Trade Desk will continue to be a leader in the marketplace for executing successful omnichannel campaigns.

As Neil Kettleborough,concludes:“The smartest media buyers don’t look for a winner. They choose the platform that best serves their objective.”

Success in today’s evolving programmatic landscape comes from aligning platform choice with campaign goals, not following trends or platform loyalty.